I stumbled across an article about Early Warning Fraud Protection system a few months ago and learned that many of the major banks in the U.S. Banded together and created a company called Early Warning which collects and shares the details of your financial transactions with each other and sells this data to customers in order for them to determine if a potential client is a fraud risk. EWS is also the operator of the Zelle payment network. OK that sounds like a rather useful business service. As a small business owner, I've been the victim of check fraud twice. In both cases we got our money back, but one required pressing charges against an individual and having to go to court and the other required lot of back and forth with our bank to convince them to cover the fraud.

Here is a link to the Article which summarizes the Early Warning System and a brief clip for those who don't want to read the whole article.

Here is a direct link to ALL of the data collection and analysis service EWS provides. https://www.earlywarning.com/products#ew--accounts

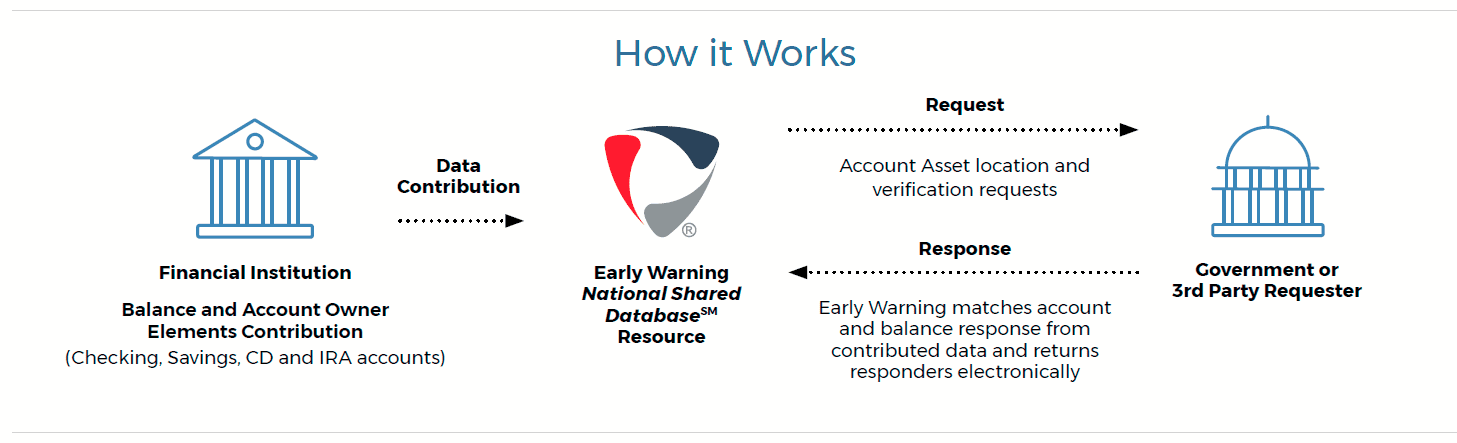

One interesting service is "Account Location Services" Basically EWS uses it's data on 600 million accounts in the U.S. to validate records and identify if a person is not reporting a specific account for some reason. Mainly they describe this service as valuable to Government Agencies trying to confirm Social Security and Medicare benefits. I could not find any information, to determine if this data is shared with other government agencies upon request OR for example lawyers looking for assets in divorce or civil claims cases.

Here is a quick flow chart of what they do.

So naturally I was curious as to what type of information EWS might have on me. You can request a copy of your personal report. It's a bit of a pain in the rear and takes a bit of time to actually get a copy. Which in some ways i guess is good, because the way this works it seems extremely difficult for someone else to obtain a copy of your data. First you have to download a copy of their form from their website here. I've attached a copy too. Basically you have to fill out your personal information and either mail, fax or use their secure email tool. I faxed it in. After a few weeks I got a letter in the mail, stating that my request for my personal report had been received, and that I needed to call a phone number to complete the request. i called the number and a live person answered. She asked me to verify my name and birth date along with some other personal info, and she confirmed the info matched their system. At that time I could request a mailed copy of the report, electronic copy or both. I opted for the electronic copy.

Yesterday about 2 weeks after the call I received an email with a linked document. The link took me to another secure site where I had to create a login and PW. Then I received an email code to access the website where my report was stored. At that point I was able to download the PDF report to my computer.

SO, What does my EWS Report Contain?

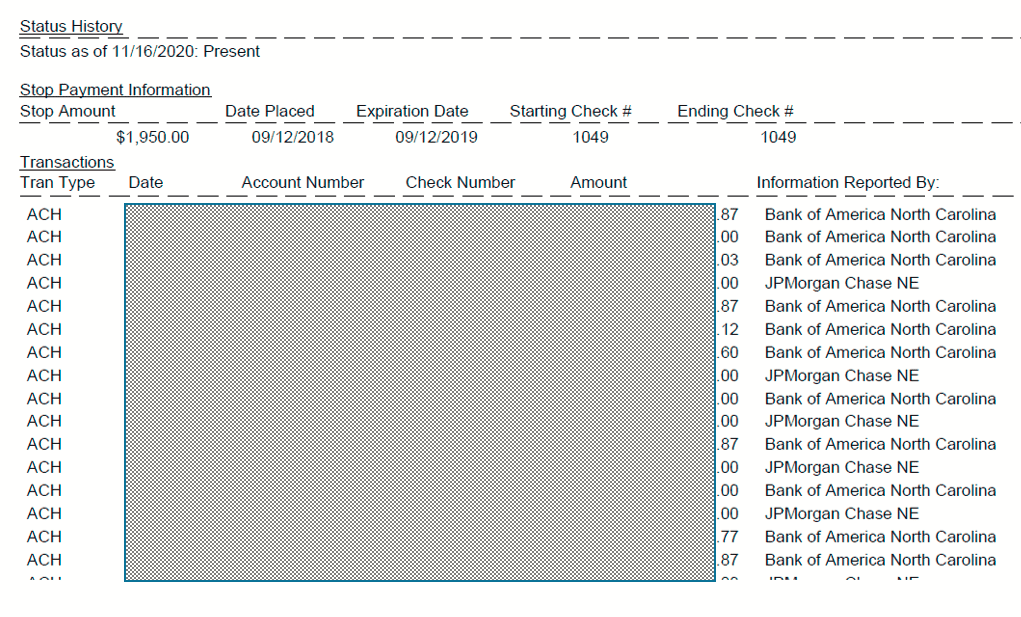

Basically MOST deposits and withdraws from any bank account you have in your name with data going back 5 years. I say most because the report seems limited to transactions over $50 but did include a few transactions down to about $25. My report was 39 pages long from two active bank accounts in my name and two accounts which were closed about 3-4 years ago.

Here is a snip of the first page from one account. I blocked out some of the transaction details.

So the report does NOT specifically list who the money came from or went to. Only that organizations banking partner. So if you buy something at Target on December 1st for $24.99 your bank would report the transaction. However, if Target's bank was part of the EWS network, you would likely see a transaction for the exact same amount on the same day for say Wells Fargo.

So on the surface it appears that the exact details of the specific transactions are masked or not recorded. I have never had a bounced check, but I did have a stop payment which was included at the very top of the report. I suspect that EWS looks for patterns of bounced checks, stopped payments and other odd activity which might indicate a higher risk of fraud.

How do I feel about a company with unfettered access to almost ALL of my banking transactions and history? We'll on one hand I'm concerned. They claim that they do not collect the actual transaction details beyond the date, amount and the banking institution which recorded the transaction. On the surface, that doesn't seem like much of a personal threat. However, there is no way of knowing if they collect ALL of the transaction details, and simply filter/mask that data from their reports. Is the data collected or stored in any way? I don't know.

You can Opt Out. In Maryland EWS falls under credit reporting, and you CAN Opt-Out. However I've read that a LOT of banks reply on EWS so opting out may actually disrupt your ability to write or cash checks at common institutions. I have NOT decided to opt out at this time. More research is needed.

Here is a link to the Article which summarizes the Early Warning System and a brief clip for those who don't want to read the whole article.

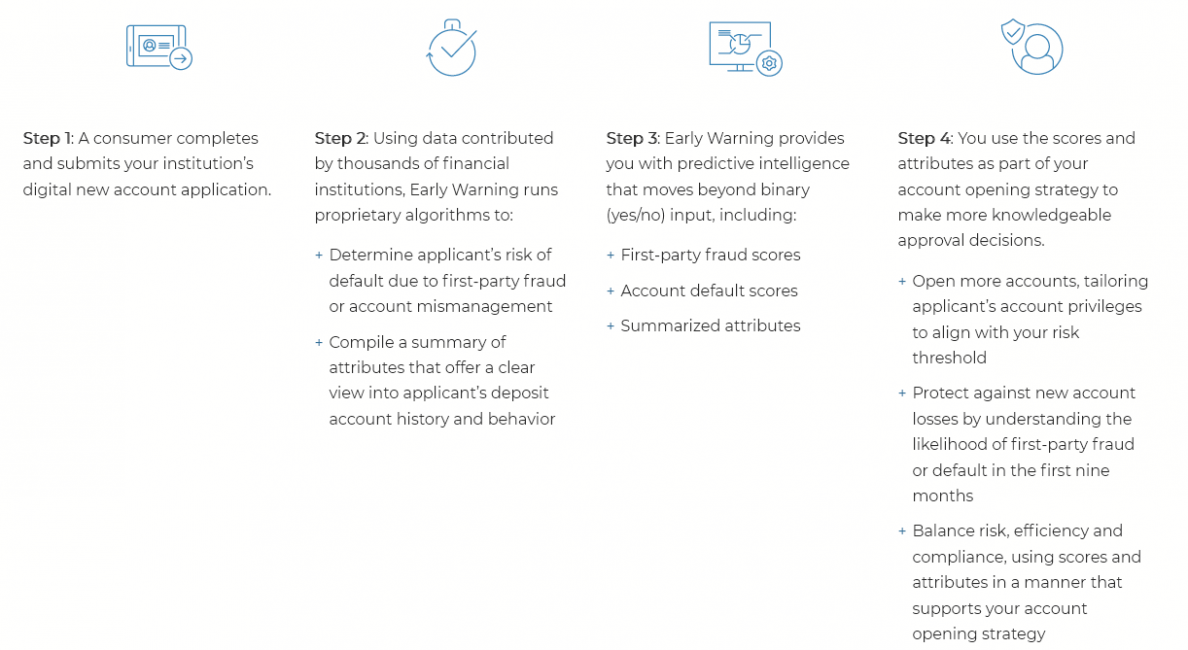

Early Warning Services LLC is a relatively new creation that allows banking institutions to evaluate the risk potential for new clients. If the applicant is deemed too risky, they are denied service at the bank or credit union. Sound familiar? Early Warning Services is similar to such services as TeleCheck and ChexSystems. EWS was created jointly by several large banks, including Bank of America, Capital One, JPMorgan Chase, PNC Bank, Truist, U.S. Bank, and Wells Fargo. It’s not always seen as competition to TeleCheck and ChexSystems; instead, it’s often considered an additional level of security during the screening process. Specifically, EWS identifies individuals who have committed financial fraud in the past. The term fraud refers to a wide variety of activities, and you may even be flagged if you inadvertently tried to cash a fraudulent check you received from someone else.

Here is a direct link to ALL of the data collection and analysis service EWS provides. https://www.earlywarning.com/products#ew--accounts

One interesting service is "Account Location Services" Basically EWS uses it's data on 600 million accounts in the U.S. to validate records and identify if a person is not reporting a specific account for some reason. Mainly they describe this service as valuable to Government Agencies trying to confirm Social Security and Medicare benefits. I could not find any information, to determine if this data is shared with other government agencies upon request OR for example lawyers looking for assets in divorce or civil claims cases.

Here is their description: EARLY WARNING’S NATIONAL SHARED DATABASESM RESOURCE Both solutions are fueled by the company’s National Shared Database Resource — the industry’s most current and accurate source of collaborative financial data, contributed by more than 600 million accounts across the country. It includes account location, status, ownership and up to 60 months of balance history.

Here is a quick flow chart of what they do.

So naturally I was curious as to what type of information EWS might have on me. You can request a copy of your personal report. It's a bit of a pain in the rear and takes a bit of time to actually get a copy. Which in some ways i guess is good, because the way this works it seems extremely difficult for someone else to obtain a copy of your data. First you have to download a copy of their form from their website here. I've attached a copy too. Basically you have to fill out your personal information and either mail, fax or use their secure email tool. I faxed it in. After a few weeks I got a letter in the mail, stating that my request for my personal report had been received, and that I needed to call a phone number to complete the request. i called the number and a live person answered. She asked me to verify my name and birth date along with some other personal info, and she confirmed the info matched their system. At that time I could request a mailed copy of the report, electronic copy or both. I opted for the electronic copy.

Yesterday about 2 weeks after the call I received an email with a linked document. The link took me to another secure site where I had to create a login and PW. Then I received an email code to access the website where my report was stored. At that point I was able to download the PDF report to my computer.

SO, What does my EWS Report Contain?

Basically MOST deposits and withdraws from any bank account you have in your name with data going back 5 years. I say most because the report seems limited to transactions over $50 but did include a few transactions down to about $25. My report was 39 pages long from two active bank accounts in my name and two accounts which were closed about 3-4 years ago.

Here is a snip of the first page from one account. I blocked out some of the transaction details.

So the report does NOT specifically list who the money came from or went to. Only that organizations banking partner. So if you buy something at Target on December 1st for $24.99 your bank would report the transaction. However, if Target's bank was part of the EWS network, you would likely see a transaction for the exact same amount on the same day for say Wells Fargo.

So on the surface it appears that the exact details of the specific transactions are masked or not recorded. I have never had a bounced check, but I did have a stop payment which was included at the very top of the report. I suspect that EWS looks for patterns of bounced checks, stopped payments and other odd activity which might indicate a higher risk of fraud.

How do I feel about a company with unfettered access to almost ALL of my banking transactions and history? We'll on one hand I'm concerned. They claim that they do not collect the actual transaction details beyond the date, amount and the banking institution which recorded the transaction. On the surface, that doesn't seem like much of a personal threat. However, there is no way of knowing if they collect ALL of the transaction details, and simply filter/mask that data from their reports. Is the data collected or stored in any way? I don't know.

You can Opt Out. In Maryland EWS falls under credit reporting, and you CAN Opt-Out. However I've read that a LOT of banks reply on EWS so opting out may actually disrupt your ability to write or cash checks at common institutions. I have NOT decided to opt out at this time. More research is needed.